All Categories

Featured

Table of Contents

- – Affordable Rates First-time Home Buyer

- – Honest Debt-to-income Ratio – Perth

- – Professional Debt-to-income Ratio – Piara Waters

- – Professional First-time Home Buyer Near Me – ...

- – Best Home Buying Process Near Me – Piara Wat...

- – Detailed Pre-approval (Piara Waters WA)

- – High-Quality Bad Credit Mortgage (Piara Wate...

- – Efficient Debt-to-income Ratio Near Me

We aren't simply speaking about celebrating Harmony week each year; the differing experiences, viewpoints, skills and histories of our home loan brokers allows us to: Have a much better interpersonal connection, far better connections with and understanding of the demands of clients. For one, it makes us subtly familiar with the different social subtleties.

What we've seen is that typically, it's the older generation that likes to chat with a person that speaks their language, even though they might have been in the nation for a long time. No matter, every Australian requirements to be 100% clear when making one of the largest choices in their life that is purchasing their very first home/property.

Affordable Rates First-time Home Buyer

For us, it's not only about the home mortgage. Most importantly, the home mortgage is a way to an end, so we ensure that the mortgage is fit to your specific requirements and goals. In order to do this, we understand and keep ourselves updated on the borrowing policies of almost 40 lenders and the plan exceptions that can obtain an application authorized.

Additionally, this straightens flawlessly with our target audience that include non-residents, freelance, unusual work, damaged credit score, reduced deposit (refinancing options), and other areas where excellent consumers are pull down by the financial institutions. To conclude, we have systems in position which are carefully checked and fine-tuned not to allow any person down. Lastly, a frequently failed to remember yet critical element when choosing a home loan broker is domain proficiency, i.e

Honest Debt-to-income Ratio – Perth

To consult with one of the ideal home loan brokers in Sydney, give us a phone call on or fill up in our brief online evaluation kind.

Professional Debt-to-income Ratio – Piara Waters

We answer a few of the most frequently asked inquiries about accessing home mortgage brokers in Perth. The role of Perth home mortgage brokers is to provide home loan funding services for their clients, using their local market expertise and experience. Perth home mortgage brokers, such as our group at Lendstreet, satisfaction themselves on locating the best mortgage financing solution for your Perth property acquisition while directing you with the entire process.

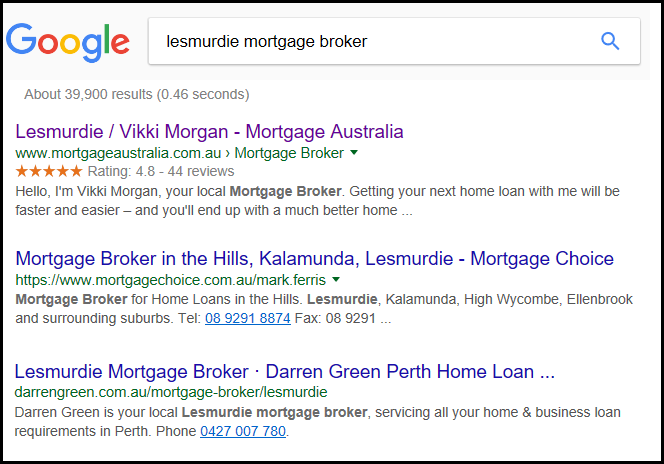

There are a great deal of mortgage brokers in Perth. Here are 10 good factors to consider me over all the others. All missed phone calls will certainly be returned within 4 company hours All e-mails received prior to 5pm will certainly be responded to in the exact same day Authorized credit rating rep (CRN: 480368) of AFG (ACL: 389087) Member of the Home Loan & Money Association of Australia (577975) Member of the Australian Financial Complaints Authority or AFCA (52529) BSc Economics from the London College of Economics Diploma of Money and Home Mortgage Broking Monitoring Certificate IV in Money and Home Loan Broking Part of a WA had and operated organization whose emphasis is entirely on the Perth market.

Over 1400 products, from more than 30 lenders to pick from. Our partnership does not end with the negotiation of your finance.

Professional First-time Home Buyer Near Me – Piara Waters 6112 WA

All information supplied is held in the strictest confidence and is dealt with in line with the 1988 Privacy Act.

In our experience as licenced home loan brokers, we can take the tension out of home mortgage comparison. We compare items from over 30+ lending institutions from the huge financial institutions to the little loan providers. We utilise just the finest and user friendly contrasting tools to determine the finest proprietor occupied or investment loan for you.

However, this isn't always the case. Reduced rate of interest can feature additional charges or lending institution restrictions. This actually can make the loan product a lot more pricey in the long-lasting. Many banks will win over customers by revealing just the promoted rate of interest without factoring in elements that include onto your car loan payments.

Best Home Buying Process Near Me – Piara Waters WA

With a lot details available, finding the most effective home mortgage prices that finest match your monetary scenario can be a tough task. It's our task to give you with full product contrasts, consisting of all the covert charges and costs to ensure that you contrast any mortgage item as properly as possible.

Our home mortgage brokers have a collective 20+ years experience in the market, are completely familiar with the fads for the Perth market making us professionals for the work. By providing a contrast tool that can help you in making a far better financial choice, we're empowering debtors and informing them along the road.

Detailed Pre-approval (Piara Waters WA)

All you need to do is give us a phone call..

I act as the intermediary in between you and the lender, making sure a smooth and efficient procedure, and conserving you the anxiety. With nearly 20 years in the home loan sector, I use extensive guidance on all elements of mortgage lending. Whether you're evaluating the advantages of a fixed-rate vs. a variable-rate mortgage or concerned regarding car loan attributes and fines, I'm right here to provide clearness and assistance.

My substantial experience and connections within the market enable me to safeguard much better rate of interest and perhaps even obtain certain charges forgoed for you. To sum up the above, the advantages of utilizing the services of a home loan broker such as myself consist of: My connections can open doors to car loan options you might not find by yourself, tailored to your distinct scenario.

High-Quality Bad Credit Mortgage (Piara Waters 6112 WA)

When you select an appropriate finance beforehand, you'll seldom need to fret about whether you can still afford it when prices enhance and you'll have a simpler time handling your month-to-month settlements. Selection is the most significant benefit that a home mortgage broker can give you with (mortgage pre-qualification). The factor is that they have relationships with a vast array of loan providers that consist of financial institutions, building societies, and lending institution

Overall, the quicker you deal with a home loan broker, the better. That's since functioning with one will certainly allow you to do even more in much less time and get accessibility to much better bargains you probably will not locate on your own. Naturally you likewise need to be careful with the mortgage broker that you select to utilize.

Other than that, ensure that they are certified - pre-approval. It might also be practical to obtain recommendations from individuals you trust fund on brokers they have utilized in the past

A home loan broker is an economic specialist who specialises in home and investment car loan funding. They attach customers with possible loan providers and help assist in the whole procedure. When you get in touch with a qualified financial broker for a home mortgage or investment finance demand, they will certainly sit with you to comprehend your certain economic needs and obtaining capacity and help you safeguard an ideal finance at a market leading rates of interest.

Efficient Debt-to-income Ratio Near Me

We don't rely on supplying an one-time solution however purpose to support a trusted relationship that you can depend on time and time once again. We recognize that every client has one-of-a-kind needs, therefore, we strive to use custom home mortgage remedies that ideal align with your preferences every time. With an impressive track record of satisfied customers and numerous continual favorable Google evaluates as social evidence, we are the leading team you need to depend on for searching for and safeguarding your next mortgage approval in Perth.

Table of Contents

- – Affordable Rates First-time Home Buyer

- – Honest Debt-to-income Ratio – Perth

- – Professional Debt-to-income Ratio – Piara Waters

- – Professional First-time Home Buyer Near Me – ...

- – Best Home Buying Process Near Me – Piara Wat...

- – Detailed Pre-approval (Piara Waters WA)

- – High-Quality Bad Credit Mortgage (Piara Wate...

- – Efficient Debt-to-income Ratio Near Me

Latest Posts

Reliable Loan Eligibility Near Me

Strategic Mortgage

Cost-Effective Equity Release – High Wycombe

More

Latest Posts

Reliable Loan Eligibility Near Me

Strategic Mortgage

Cost-Effective Equity Release – High Wycombe